What Is Liquidity Provisioning on AMMs and Where Does the Yield Come From?

Decentralized exchanges (DEXs) allow users to trade crypto assets without a central intermediary. Instead of matching buyers and sellers through an order book, most DEXs rely on Automated Market Makers (AMMs). AMMs are the foundation of decentralized trading — and liquidity providers (LPs) are the participants who make these markets work. This article explains what liquidity provision is, how AMMs work at a high level, and where LP yield comes from.

Published: 2 months ago

Read time: 3 min / 415 words

What Is Liquidity Provision (LPing)?

Liquidity provision means depositing two assets into a liquidity pool on a decentralized exchange.

For example:

An LP deposits ETH and USDC into an ETH/USDC pool

Traders swap between ETH and USDC using this pool

The LP earns a portion of the trading fees

By supplying assets, LPs enable continuous trading and are compensated for providing this service.

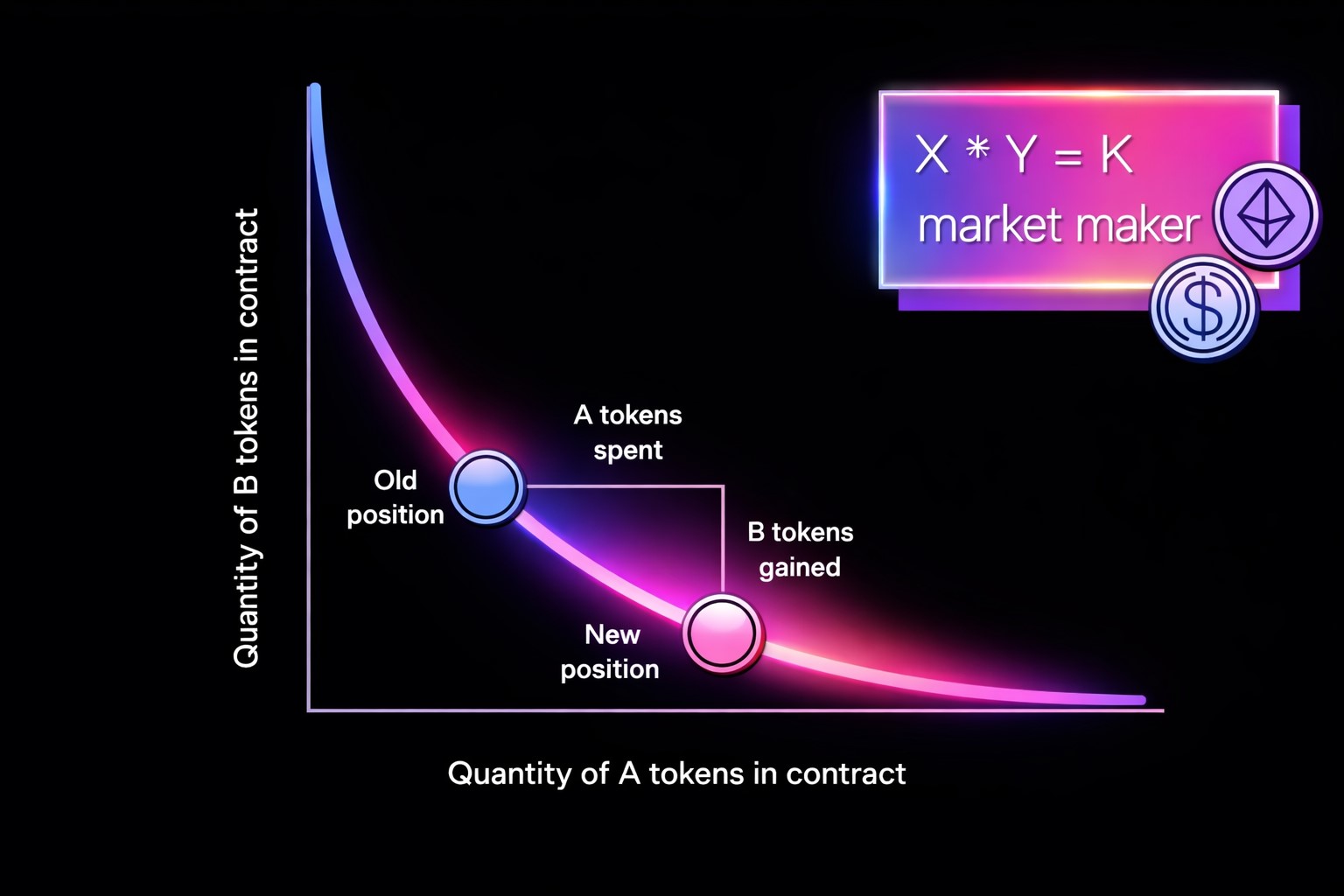

How Does an AMM Work?

An Automated Market Maker is a smart contract that:

Holds a pool of two assets

Sets prices automatically based on supply and demand

Executes trades directly against the pool

When a trader swaps one asset for another:

One asset is added to the pool

The other is removed

The price adjusts automatically

There is no buyer–seller matching.

Instead, the pool itself is always the counterparty.

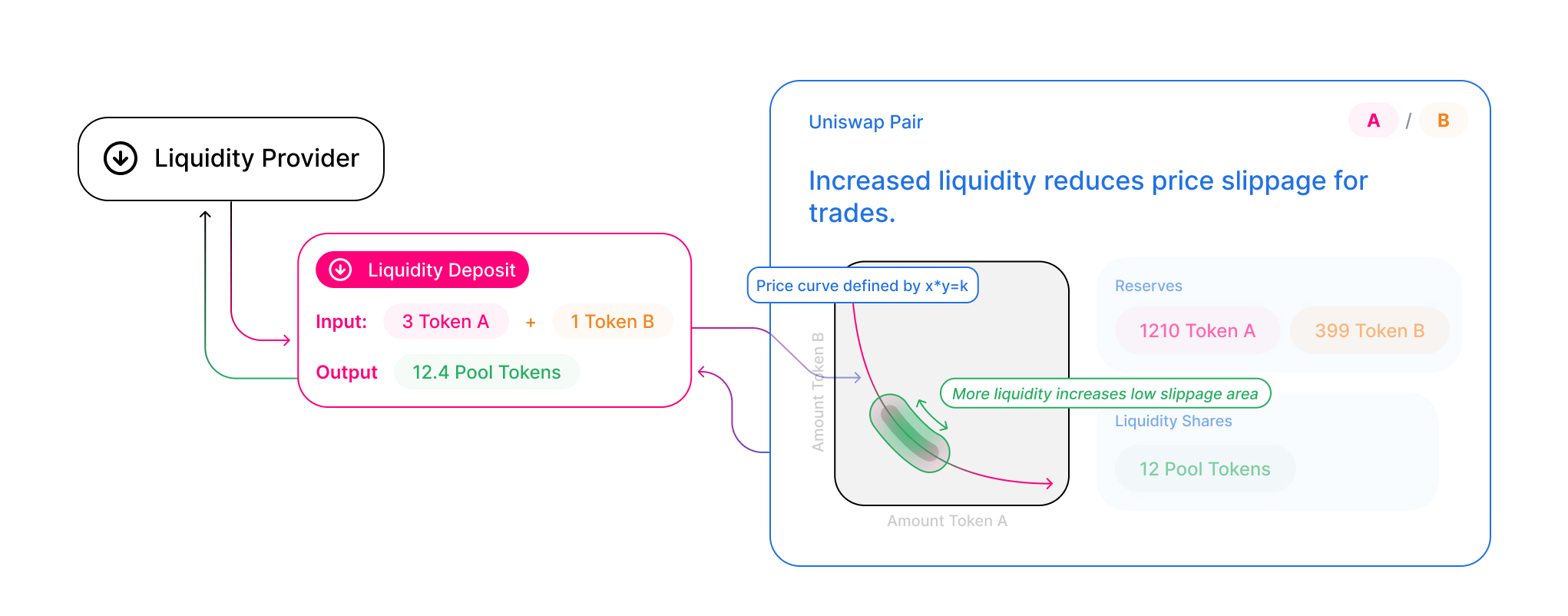

Visual: How an AMM Facilitates a Trade

Source: How Uniswap works, 2025

How to read the diagram:

Liquidity providers deposit two assets into a pool

Traders swap one asset for the other

The AMM adjusts the price automatically

Trading fees are collected and distributed to LPs

This mechanism allows trading to happen continuously, without intermediaries.

Where Does LP Yield Come From?

LP yield primarily comes from trading fees.

1. Trading Fees

Every trade on an AMM pays a small fee.

These fees are:

Collected by the protocol

Distributed to liquidity providers

Proportional to the amount of active liquidity

More trading activity generally means higher fee income.

2. Market Activity

Liquidity provision benefits from active markets:

Frequent trading

Back-and-forth price movement

High on-chain volume

This means LP strategies can perform well even when prices move sideways.

3. Protocol Incentives (Optional)

Some AMMs offer additional rewards, such as:

Incentive tokens

Liquidity mining programs

These incentives can enhance returns but are typically temporary and should not be viewed as permanent yield.

What Are the Risks?

Liquidity provision is not risk-free.

Key risks include:

Price movements of the underlying assets

Impermanent loss, when asset prices change relative to each other

Smart contract risk

Successful LP strategies balance fee generation against these risks.

Liquidity Provision as a Yield Strategy

Liquidity provision earns yield by:

Enabling decentralized trading

Providing liquidity when it is needed

Capturing fees from real economic activity

Rather than relying on price appreciation, LPing focuses on earning yield from usage and volume.

At Yieldhaus, liquidity provision is treated as a structured yield strategy, combining market selection, active management, and disciplined risk control.

Summary

AMMs power decentralized exchanges

Liquidity providers supply assets to trading pools

LPs earn yield primarily from trading fees

Concentrated liquidity improves capital efficiency

Yield comes from market activity, not speculation

Liquidity is the engine of DeFi — and providing it is one of the most fundamental ways to generate sustainable on-chain yield.